An important benefit you may be entitled to if you have limited savings and a low income

If you’ve reached State Pension age, you may be able to claim Pension Credit to top up your income if it is low. Four out of 10 people who are eligible fail to claim it, so it’s worth checking whether you’re entitled to it.

There are two parts: Guarantee Pension Credit and Savings Pension Credit

Guarantee Pension Credit tops up your income to a guaranteed minimum amount set by the government. You could get a higher amount if you’re a carer, disabled, or have certain housing costs. You could be eligible even if you have savings, a pension or own your own home.

Savings Pension Credit is an extra payment for people who have saved some money towards their retirement. It is being phased out and you can only claim it if you reached State Pension age before 6 April 2016.

Simple guide to applying for Pension Credit as a carer where you live

The government estimates that up to 880,000 pensioners are eligible for Pension Credit but do not claim it. The process for applying for Pension Credit can be complicated. This is why we've made the guide below to encourage you to see if you can apply for Pension Credit.

This year, it is more important than ever to check whether you may be eligible for Pension Credit. Recent changes mean that only those who receive Pension Credit or other means-tested benefits will be able to continue receiving a Winter Fuel Payment this winter.

How can I find out if I'm eligible?

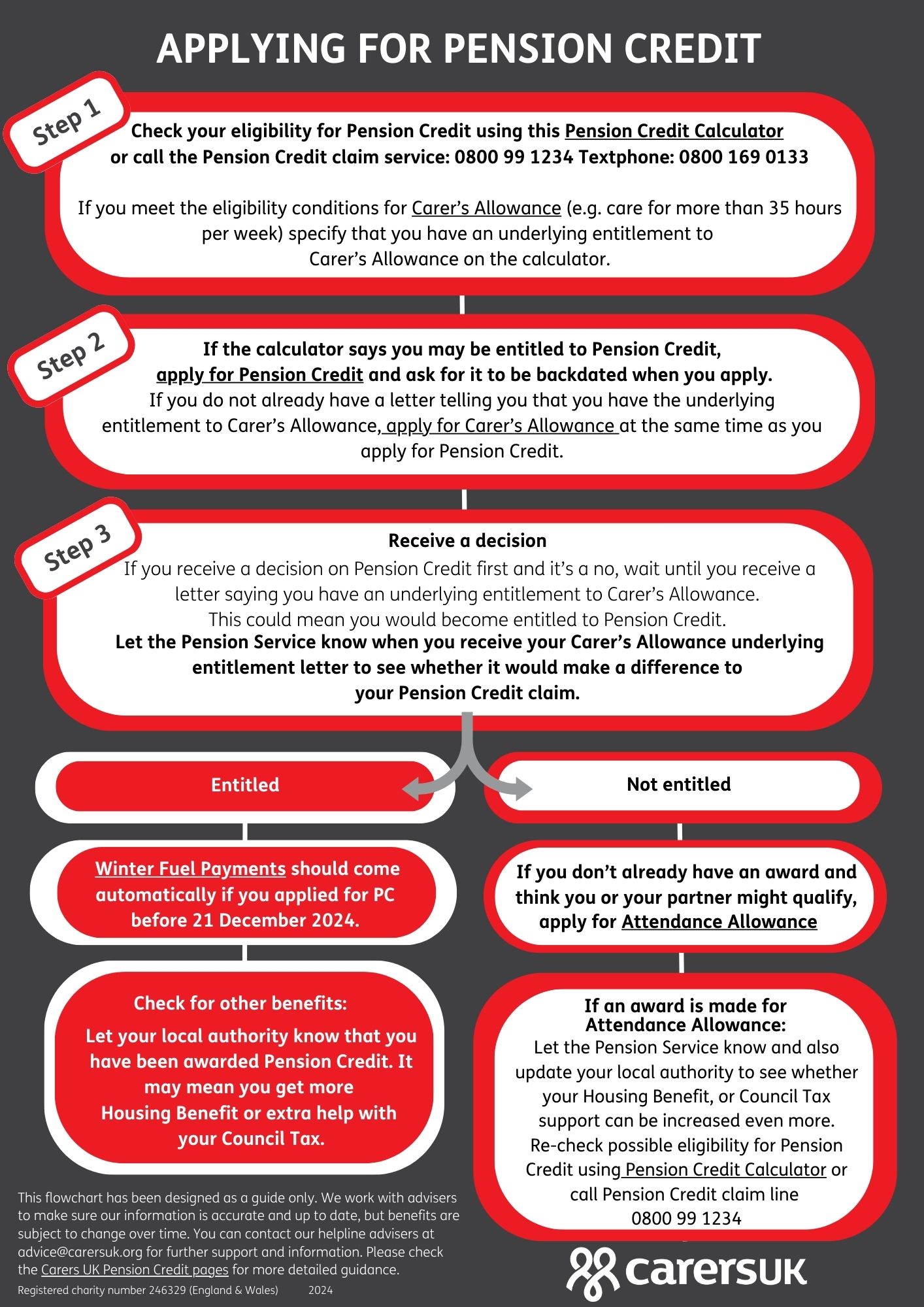

The infographic below shows the 3-step process involved. As a carer, it may be a good idea to apply for Carer’s Allowance as well if you meet the criteria. Even if you know you will not be paid this benefit alongside what would be seen as an overlapping benefit such as a pension, you may be assessed as having an ‘underlying entitlement’. Ultimately, this would mean that you are more likely to be eligible for Pension Credit and may get a higher amount.

Is there a deadline?

There is no deadline to apply for Pension Credit – if you get an award, you will be better off in the future.

When you apply for Pension Credit, it's important to ask for this to be backdated in the application – this should help you to receive the Winter Fuel Payment.

A guide to see if you can apply for Pension Credit - to become eligible for Winter Fuel Payments

Further information

See the tabs further below for answers to frequently asked questions about Pension Credit.

Are you eligible?

You may be eligible for Guarantee Pension Credit if you’ve reached State Pension age and live in the UK, the Channel Islands or the Isle of Man. You can check your current State Pension age on GOV.UK.

Find out about Pension Credit in Northern Ireland.

What income counts?

Generally you must have a low income to be entitled to this benefit, but you may still qualify if you’re a carer, disabled or have certain housing costs.

Income that's taken into account for Guarantee Pension Credit includes your earnings, some benefits (including Carer’s Allowance), tax credits, State Pension and private pensions. Some income is disregarded, including any disability benefits you receive, Child Benefit and child maintenance.

What about savings?

You can still get Guarantee Pension Credit if you have savings, although anything over £10,000 will reduce the amount you get.

If you’re a couple, both of you must be over State Pension age to claim. If only one of you is over State Pension age, you will need to claim Universal Credit instead.

How can I check?

On the Gov.uk website, there is a Pension Credit calculator which can be used to see if you might qualify: gov.uk/pension-credit-calculator

Savings Pension Credit is being phased out, so not many new claimants can get it. You may be eligible if you or your partner reached State Pension age before 6 April 2016. It rewards people with a small amount of extra money each week if they have saved towards their retirement. Working out how much you could get is complicated, so contact the Carers UK Helpline for advice at advice@carersuk.org.

Guarantee Pension Credit tops up your income to a guaranteed minimum amount. In 2025/26, this is £227.10 a week for a single person and £346.60 for a couple. There are also additional amounts that can be added to this depending on your circumstances.

If you’re a carer

If you’re entitled to Carer’s Allowance, you can get a Carer Addition of £46.40 (2025-26) a week added to your minimum amount.

This might also be known as a Carer Premium - however it's called a Carer's Addition if you've reached State Pension age when it's added to Pension Credit. Read more about what this is here: What is the Carer Premium? | Carers UK

If you’re severely disabled

You can get a Severe Disability Addition of £82.90 (2025-26) added to your minimum amount if all the following apply:

- you claim one of the following disability benefits: the daily living component of Personal Independence Payment, the middle or higher rate care component of Disability Living Allowance, Attendance Allowance, Constant Attendance Allowance or Armed Forces Independence Payment

- no-one gets Carer’s Allowance or the carer element of Universal Credit for looking after you

- you live alone (there are some exceptions to this, for example if you just live with your partner and they also claim a disability benefit).

If someone has an ‘underlying entitlement’ to Carer’s Allowance for looking after you, you can still receive a Severe Disability Addition. An underlying entitlement means they are entitled to Carer’s Allowance for looking after you, but can’t be paid it because they receive another benefit that overlaps with it.

If you have housing costs

If you own your home and pay costs such as service charges or ground rent, you may be able to get help with these through Guarantee Pension Credit.

If you’re responsible for a child

If you’re responsible for a child or young person who normally lives with you, you may get a ‘child addition’ added to your minimum amount.

Does it help me access other support?

Even if you’re only entitled to a small amount of Pension Credit, it’s worth claiming as it means you qualify for other benefits and concessions. For example, you could get:

- your rent and Council Tax paid in full, depending on your circumstances

- free NHS dental treatment and sight tests

- Winter Fuel Payments or the Pension Age Winter Heating payment in Scotland

- help with the cost of glasses or contact lenses

- help with travel costs to hospital for NHS treatment

- a Cold Weather Payment when the temperature is 0 celsius or below for a week

- money off your electricity bill through the Warm Home Discount Scheme

- a free TV licence if you’re 75 or over.

Claiming options

When you put in a claim for Pension Credit, note that you can backdate this claim for three months (as long as you were eligible at that time).

In England, Wales and Scotland, you can call the Pension Credit claim line on 0800 99 1234 (Mon-Fri, 8am-6pm) Textphone: 0800 169 0133. If you have difficult speaking/ hearing, you can use the Relay UK service: 18001, then 0800 99 1234.

The person you speak to will fill in the form over the phone with you and send it to you to check.

You can also apply online, which is currently the quickest way to apply.

To apply by post, you can download and print out a claim form from GOV.UK, or call the claim line for a form.

In Northern Ireland, you can call the Pension Credit Application Line on 0808 100 6165, apply online or download a claim form from NI Direct.

Remember that you can ask for Pension Credit to be backdated for up to three months.

Need help applying?

There are a number of organisations that can help with applying and filling in forms like this.

Look up the one in your area using Advicelocal: https://advicelocal.uk/

Your local Age UK, can also offer support: https://www.ageuk.org.uk/

You can also watch our handy 3-minute animated video guide.

If your personal circumstances or your income or savings change, you must report this as it could affect your eligibility for Pension Credit.

In England, Wales and Scotland, call the Pension Service on 0800 731 0469. In Northern Ireland, call the Northern Ireland Pension Centre on 0800 587 0892.

Start by asking for a mandatory reconsideration. This means the decision maker has to look again at the decision they made. If you still disagree with the outcome after this, you can make an appeal. Find out more in our guide to challenging a benefits decision.

See our video for further information and guidance on Pension Credit: